- Credit score ranges equifax for free#

- Credit score ranges equifax verification#

- Credit score ranges equifax download#

When someone applies for a loan at a bank or other financial institution, the lender initially looks at the applicant’s CIBIL score & record. The CIBIL score is very important in the mortgage application procedure. Still, it is normally a three-digit figure varying from 300 to 900, with the latter being the greatest score. Various credit information businesses have created ways of establishing credit ratings. The credit bureau calculates their credit score based on how effectively users have maintained their credit, loans, and so on. As a result, the credit bureau gathers and keeps a record of all mortgages, credit cards, payback history, and other personal identifiers. If users take out a loan, finance firm, or institution, the data is communicated with a credit agency, including debt control facts. CIBIL provides premium plans that provide access to various additional services based on their selected program. Anyone can view their present CIBIL Report with a complimentary membership once a year.

Credit score ranges equifax for free#

One may also register a report online.Īnyone may check their credit score on the CIBIL website for free or by purchasing a subscription plan.

Credit score ranges equifax download#

Anyone can download & email the finished Dispute Settlement Form and the required authentication evidence to the website’s location. After online verification, the credentials are sent to one’s email address. The credit record gets delivered after papers get verified, which might take up to seven days.

Credit score ranges equifax verification#

159.įollowing the verification of identification papers, a credit score will be issued. One can purchase their credit history by DD for Rs. Payment methods include NetBanking, debit cards, and Cash cards. One-time credit rating and analysis for Rs 550. The credit score costs Rs 400, while the Basic Report is Rs 138.

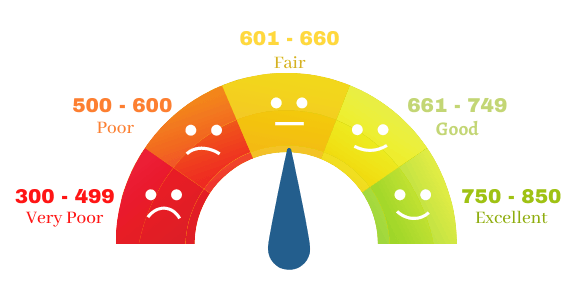

A CIBIL score of 750 or more is considered excellent, whereas a score nearer to the low side of the range is considered bad. A grade of 900 or more, over 750, is considered great, whereas a score of 300 or lower is considered bad.ģ00-900. It’s essentially an overview of the CIBIL Report that reflects company creditworthiness.ĭifferences Between Cibil And Equifax Componentsģ00-900. This score is calculated based on the credit record included in the CIBIL Report/Credit Data Analysis. Per the CIBIL site, any score better than 750 is considered an excellent CIBIL Score and aids lenders in evaluating and accepting their loan applications. The nearer a user’s CIBIL Score is 900, the more likely their bank card or loan request will be accepted. The CIBIL score is a three-digit numerical evaluation of a user’s credit record that reflects the individual’s credit character. Remember that it requires time to build a track history of solid financial judgments and, ideally, raise the credit score. If users have problems borrowing money due to their credit report, there are things one may do to restore it. Users might have rejected a loan, bank card, or property application due to a poor credit score. They collect information about individuals to build their credit history, which is ultimately used to determine their credit score and predict their likelihood of being accepted for financial goods. However, differences in detailed ratings between the bureaus for the same customer are possible, although they are doubtful to be significant. If users make a mistake, their credit application may decline due to a low credit score.īoth credit ratings are almost identical.

The remaining two credit reporting companies are Experian and High Mark. Both are two among the four credit data companies licensed in India. They give a creditworthiness rating depending on the information they gather about customers and businesses. Equifax and CIBIL are credit organizations that collect financial information from various financial institutions around the country.

0 kommentar(er)

0 kommentar(er)